Introduction

In November 2025, the Science Based Targets initiative (SBTi) launched a second public consultation on its Corporate Net-Zero Standard (CNZS) v2.0. As the international reference standard for corporate climate ambition, this revision aims to align the framework with the latest climate science while addressing practical implementation challenges.

Indeed, following the first consultation in early 2025, the SBTi has refined its framework to ensure targets are not only scientifically aligned but also practically achievable. Thus, this version incorporates feedback from the market to balance high ambition with technical feasibility.

At Carbometrix, we welcome this evolution, as we had identified several methodological and operational complexities in the initial version of the CNZS released in early 2025 that this update seeks to address. However, it is clear that while v2.0 is designed to be more pragmatic, it also sets a significantly higher bar for ambition and technical rigor, making it more challenging to implement than the current version of the standard.

In this article, we highlight what we believe are the most critical shifts introduced in this second consultation. However, it is important to note that the final version of the CNZS v2.0 is not expected before mid-2026. As the framework has already undergone substantial changes since the first consultation, in particular regarding the target-setting methodology, we cannot yet be certain which proposals will be retained in the final publication.

Overview of the key proposed evolutions

Four key areas of evolution have stood out during our review:

The formalization of the new company categorization,

SBTi’s efforts to strengthen the credibility of its Corporate Standard,

the methodological shifts in target-setting,

the new proposals to increase recognition for ongoing emissions.

1. Adjustment of the companies categorization

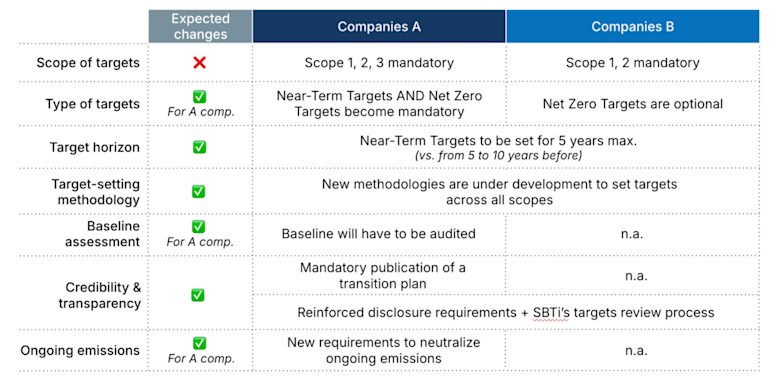

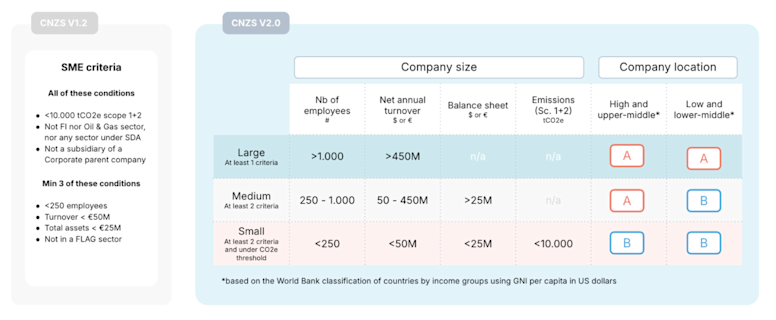

One of the most structural changes in v2.0 is the formal distinction between Category A and Category B companies based (i) on size and (ii) geographies. This distinction was already introduced in the first consultation draft and is confirmed:

Category A: Large companies and medium companies operating in high or upper-middle-income geographies. They will face the most stringent requirements, including mandatory long-term targets (Net Zero targets) on all 3 scopes, third-party audits of their baseline and publication of a transition plan.

Category B: Small companies of all geographies and medium companies operating in low or lower-middle-income geographies. For these organisations, several requirements remain optional, such as setting scope 3 targets, publishing a transition plan or defining Net-Zero ambition by 2050.

2. Reinforced credibility requirements

Under the previous framework, the SBTi’s role was confined to an initial "gatekeeping" function. Once a company’s targets were validated as scientifically aligned and its baseline appeared coherent with its sector, the oversight essentially ended. Thus, many argued that there was a significant "accountability gap" between the initial validation and the final target year (often 5 to 10 years later). The CNZS v2.0 aims at reducing this gap through (i) the introduction of a batch of new requirements for companies and (ii) the evolution of its commitment process.

Thus, Category A companies will need to have their “baseline”, i.e. base year for carbon data which serves as the reference point for all target calculations, audited and validated by an independent third party. The level of assurance is still under consultation, but a minimum of “limited assurance” is likely to be required. They will also be required to set long-term targets (Net Zero targets), which is optional under the current version of the CNZS (version 1.3).

Under the new version of the standard, Category A companies will also be mandated to publish a formal transition plan, serving as a granular blueprint to demonstrate the operational and financial feasibility of their Science-Based Targets. A set of mandatory elements will likely have to be included:

The detail of the SBTs and of the actions to achieve them,

an implementation roadmap,

corresponding timeframe,

associated implementation costs.

The publication of a transition plan should remain optional for category B companies, but we believe at Carbometrix that building a robust transition plan, and disclosing it, will be a critical lever of credibility for all companies willing to prove the rigor of their decarbonisation ambition.

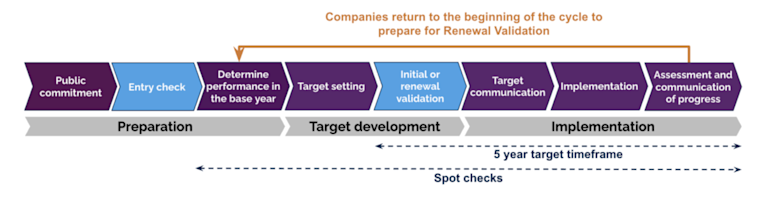

Finally, the v2.0 aims at shifting from a static approval process to a continuous monitoring regime. Thus, the SBTi aims at having its target-setting and submission process evolved (see chart below). We believe two key updates deserve particular attention:

Mandatory 5-year timeframe for Near-Term Targets: while the current standard allows a window of 5 to 10 years, v2.0 will mandate a strict 5-year timeframe. The objective is to ensure that decarbonization starts rapidly rather than being pushed towards the next decade.

Introduction of “spot checks”: to move away from a 'set-and-forget' mentality, the SBTi is introducing periodic spot checks. These audits are designed to verify, throughout the target lifecycle, that companies are actually on track and implementing their transition plans as promised, significantly increasing the continuous accountability of validated firms.

3. A completely revamped target-setting methodology

One of the most significant shifts of the CNZS v2.0, particularly when compared to the first consultation in early 2025, lies in how targets shall be set across all three scopes. Without entering too much into technical details, here is what could be expected in the new version of the standard.

Scope 1

The SBTi introduces more flexibility to set targets on scope 1 to reflect the operational realities of capital-intensive industries. Companies may choose between three distinct approaches:

Linear contraction: a year-on-year absolute reduction target, similar to the unique target-setting option on scope 1 in the current version of the standard (v1.3);

Alignment targets: specifically for heating (space, water, process) and transport, where the goal is to linearly increase the share of low-carbon activities.

Asset decarbonization plan: this option is designed for capital-intensive sectors, and allows for a carbon budget aligned with a specific timeline for replacing or phasing out high-emissive assets (with a 5-year target window).

Scope 2

Three major shifts are considered under the new version of the standard:

100% low-carbon electricity by 2040: this is a mandatory target to be achieved linearly. Category A companies must also set a long-term target of 100% coverage.

"Hourly matching" requirement: for large consumers (>10 GWh/year per region), the SBTi moves beyond annual "netting." Companies will likely have to roadmap a transition toward matching green power supply with actual consumption on an hourly basis, ensuring real-world grid impact.

Strict geographical sourcing: Energy certificates (GOs, RECs) will have to originate from the same interconnected grid as the consumption, preventing the use of certificates from unrelated markets.

This methodology is designed to align with the GHG Protocol’s ongoing Scope 2 revision, that Carbometrix is also contributing to. Consequently, the SBTi may integrate further adjustments depending on the protocol’s final conclusions regarding accounting rules.

Scope 3

Scope 3 remains optional for Category B but becomes highly structured for Category A, with a shift from generic target-setting options in v1.3 (absolute reduction, intensity reduction and/or supplier engagement) to category-specific levers.

All categories representing more than 5% of total scope 3 GHG emissions must be covered by Science-Based Targets - whereas the threshold under the v1.3 was to have at least 67% of total scope 3 emissions covered by SBTs.

In addition, SBTi has identified many categories and sub-categories of Scope 3 emissions that would become out-of-scope, and thus excluded from the Scope 3 target perimeter:

Purchases from micro-SME suppliers

FERA emissions (category 3.3)

Upstream and downstream transport “where no means of influence exist”

Employee commuting

Emissions from sold intermediate products, upstream/downstream leased assets and franchises, under certain control conditions

This would induce massive simplifications as some of these categories were known to generate many issues when setting targets and building decarbonization plans (ie. FERA and employee commuting).

We list here below the proposed options of the SBTi to set targets per GHG-Protocol’ scope 3 categories:

Scope 3 Cluster | GHG Protocol Categories | Target-Setting Options (CNZS v2.0) |

Purchased Goods & Services and Capital Goods | Cat. 1 & 2 | • Emission intensity/volume alignment (tCO2e/t meets the relevant reference benchmark) for priority commodities only • Supplier alignment (% of spending/emissions covered by suppliers with SBTs) for all commodities |

Logistics & Travel | Cat. 4, 9 & 6 | • Emission intensity/volume alignment (gCO2e/t.km meets the relevant reference benchmark) • Supplier alignment (e.g., carriers with SBTs) • Zero-Emission Vehicle (ZEV) adoption (% of fleet/volume) |

Use of Sold Products (USP) | Cat. 11 | • Energy efficiency alignment (e.g., % of sales reaching top-tier energy labels by 2040) • Customer alignment (e.g., % of revenue from clients with SBTs) • Fossil fuel phase-out (mandatory exit for products linked to fossil fuel extraction/processing) |

End of Life | Cat. 12 | • Circularity targets (e.g., % of products meeting verified circularity standards like ISO 59040 by 2050) |

Miscellaneous | Cat. 5, 8, 10 & 14 | • Supplier/customer alignment (e.g., % of purchase/revenue from suppliers/clients with SBTs) |

It must be noted that all supplier and customer engagement targets do not imply having targets validated by the SBTi at the supplier and customer level, as the third-party verification of SBTs is only recommended.

4. Taking responsibility for ongoing emissions

The SBTi CNZS 2.0 draft introduces a framework for companies to take responsibility for their ongoing emissions while transitioning to net-zero, which shall remain an optional recognition program until 2035.

To get a "recognized" status, companies must take responsibility for at least 1% of ongoing scope 1-3 emissions through supplementary climate contributions, such as supporting ex-post mitigation outcomes or applying a carbon price.

The "leadership" status would require companies to take responsibility for 100% of ongoing emissions by applying a minimum carbon price of USD 80/tCO2e to establish a budget, which should then be used to deliver ex-post mitigation outcomes equivalent to at least 40% of ongoing emissions.

Under the revised version of the CNZS v2.0, Category A companies will face a mandatory requirement starting in 2035 to take increasing responsibility for a portion of their ongoing emissions, progressively building toward complete neutralization by their net-zero target year. At the net-zero target year and beyond, all companies will have to neutralize 100% of their residual emissions across scopes 1, 2, and 3 using carbon dioxide removals, with 41% mandatorily stored in long-lived reservoirs.

Timeline: what to expect, and when?

The transition to the CNZS v2.0 is designed to be gradual, allowing companies to adapt to the significant changes planned.

Following the conclusion of this second consultation and a subsequent pilot testing phase, the SBTi expects to publish the final version of the CNZS v2.0 by mid-2026. A transition period will follow, during which companies may continue to submit targets under the current v1.3 standard until December 31, 2027. This means that the v2.0 framework will only become mandatory for all new submissions starting January 1, 2028.

For companies that have already secured validated targets under the current v1.3 standard, there is no immediate obligation to re-submit. The existing validated targets remain valid through the end of their original timeframe. However, any future target updates or mandatory five-year recalculations occurring after the 2028 deadline will be required to align with the v2.0 framework.

Conclusion: Carbometrix’s take on this second consultation

At Carbometrix, we believe the proposed Corporate Net-Zero Standard (CNZS) v2.0 remains significantly more ambitious than the current v1.3, particularly through its reinforced accountability measures and the introduction of mandatory transition plans for large organizations.

At the same time, this version is decidedly more practical than the initial draft issued in March 2025. This new version of the CNZS demonstrates that the SBTi has taken into account market feedback, including the methodological and operational complexities that we highlighted during the first consultation.

For companies and investment funds, our recommendation is clear: this upcoming evolution of SBTi’s corporate standard should not be viewed as an obstacle to setting targets. The final version of the CNZS v2.0 is not expected until mid-2026 and companies will be able to submit and validate new targets under the current CNZS (v1.3) until the end of 2027. Existing validated targets remain valid until the end of their designated timeframe, providing companies with a stable regulatory window for the upcoming years.

At Carbometrix, we believe this window can be used strategically: companies can choose to validate targets under the current rules now, while simultaneously upgrading their data systems to meet the higher transparency and granularity expectations of v2.0 in the future.