Navigating the climate framework jungle (PMDR, NZIF, and SBTi)

For years, financial institutions have relied on financed emissions and carbon intensity (WACI) to track their portfolio's climate impact but these metrics do not always tell the whole story. Between volatile enterprise values, frequent portfolio entries and exits, and the "masking" effect of high emitters, it’s hard to see the real decarbonization efforts being made by individual assets.

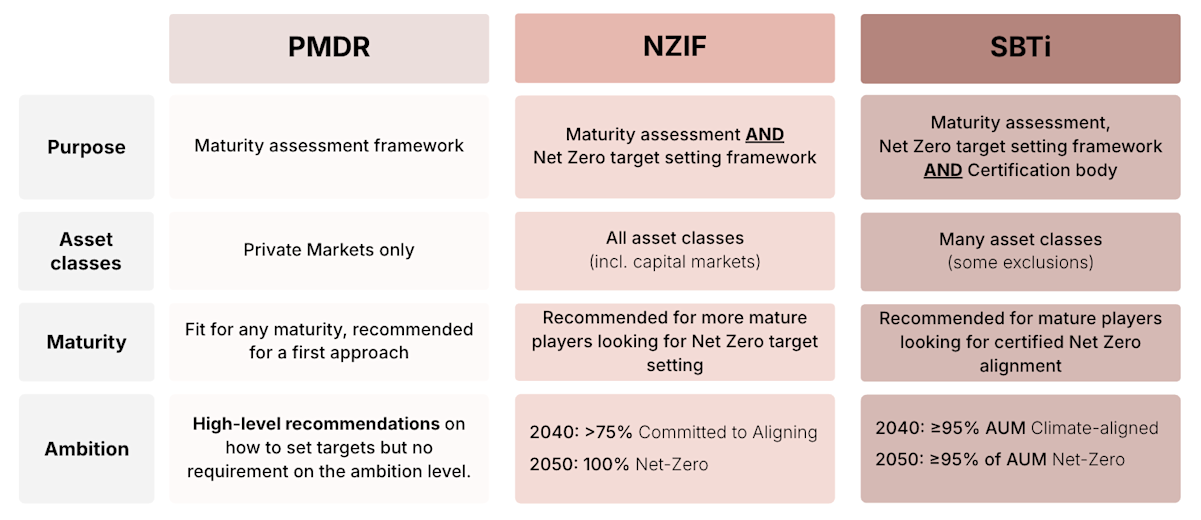

To move from snapshot data to monitoring the ambition and progress, the industry has been shifting toward climate maturity frameworks. In our recent webinar, we explored the three leading standards: PMDR, NZIF, and SBTi. Here is how they stack up and, more importantly, how they can work together to drive your engagement strategy.

The maturity spectrum: A comparative overview

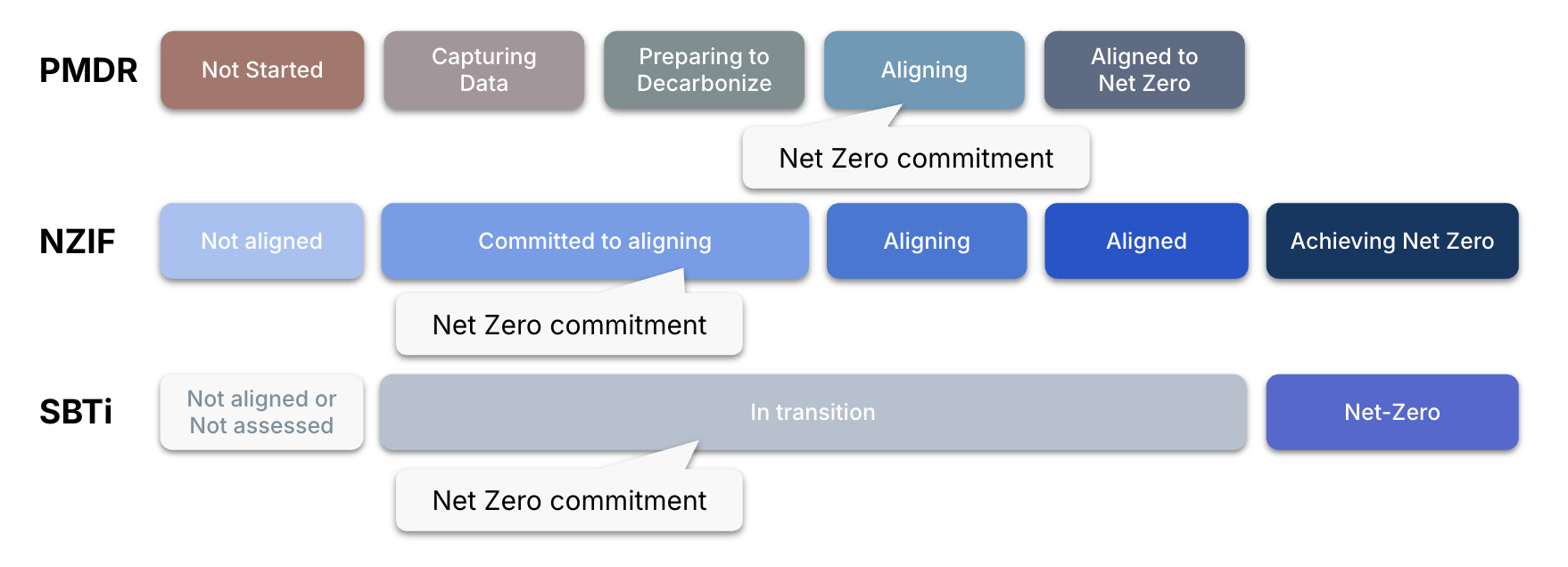

Rather than choosing just one, think of these frameworks as a progression. They offer different levels of granularity and "strictness" depending on your institution's needs, resources and ambitions.

PMDR - for private assets progressing in maturity :

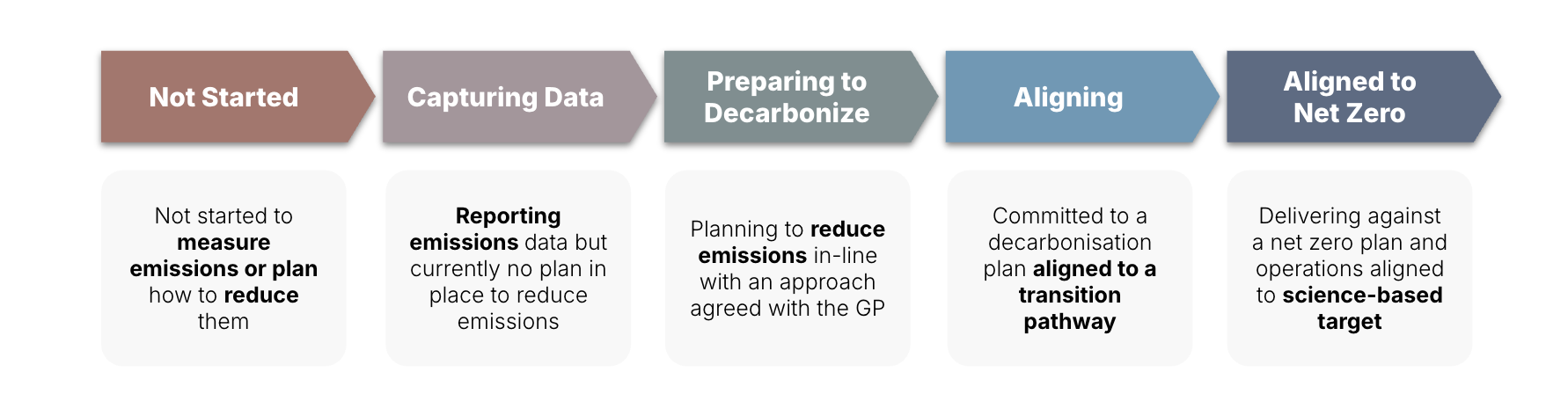

Use the Private Market Decarbonization Roadmap (PMDR) to get your portfolio moving. Its 5-stage scale (from "Not Started" to "Aligned to Zero Aligned") is excellent for capturing early progress and reporting your portfolio climate maturity to LPs. It’s usually a good fit for Private Market actors that need a granular way to track how their portfolio companies are maturing, even if they aren't ready for a 1.5°C target yet.

📖 If you’re interested in knowing more, read our full article on PMDR here, or check out the replay of our webinar.

NZIF - when looking at a NZ commitment with flexible targets

The Net Zero Investment Framework provides specific guidance for various asset classes (private equity/debt, listed equity, sovereign bonds, infrastructure, real estate) to set net zero targets for your portfolio. It is the best option if you’re looking to set targets and track maturity, without engaging in a validation process. NZIF is quite flexible: it contains mainly recommendations, but nothing is strictly mandatory:

Target perimeter can be freely chosen, and focus can be put on “material sectors” only

Intermediate milestones can be freely set (e.g., accelerating later in the decade)

Exceptions to recommendations are allowed as long as they’re justified

NZIF sets an ambition level aligned with the Paris Agreement

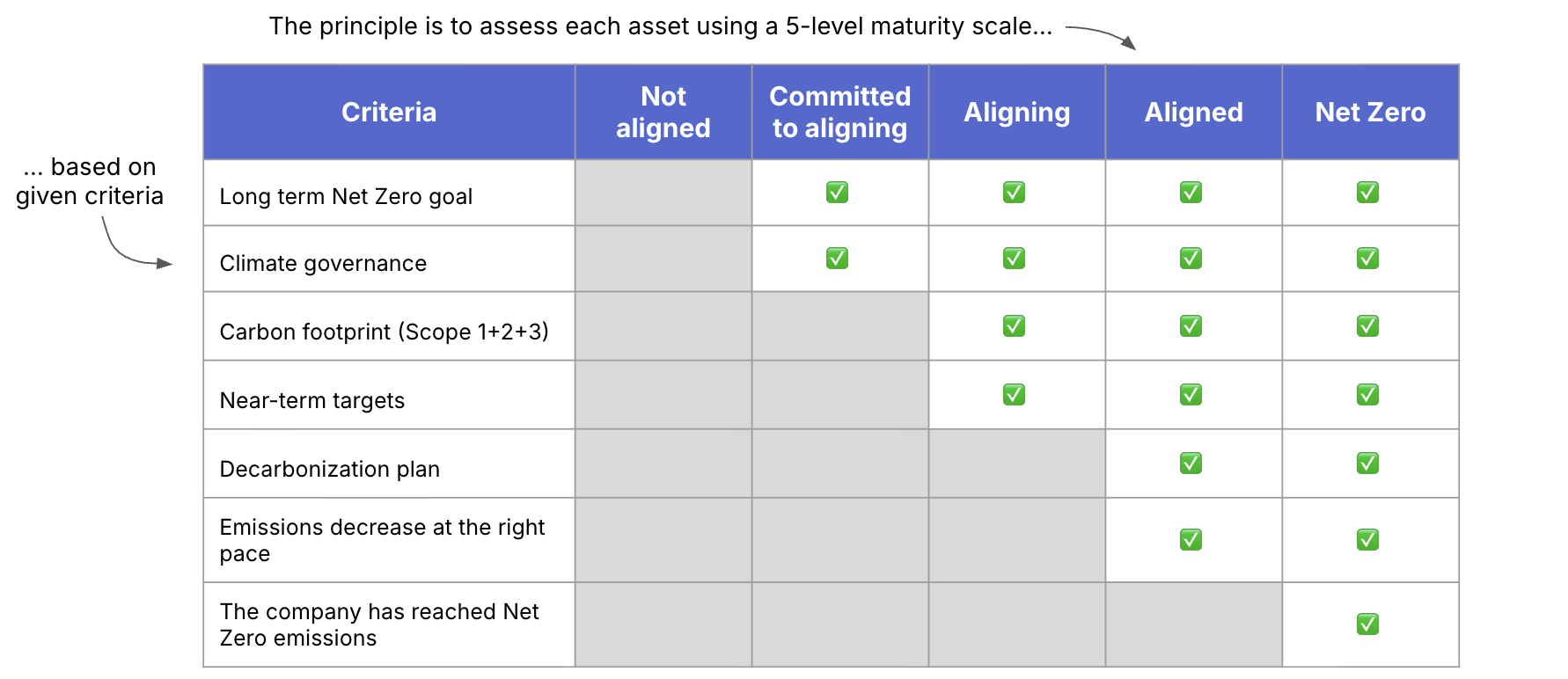

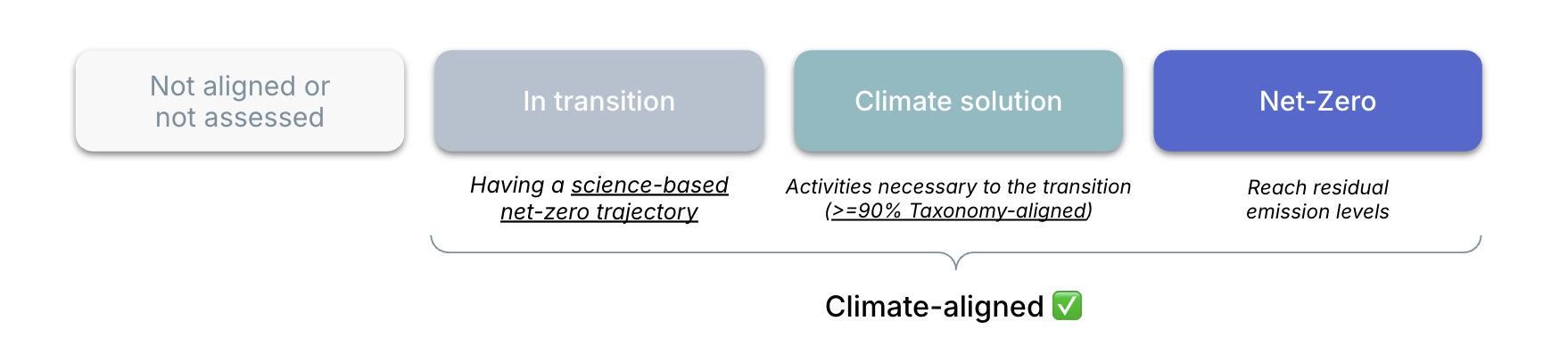

The portfolio alignment target relies on classifying the assets according to their climate maturity level

SBTi - For formal NZ commitment

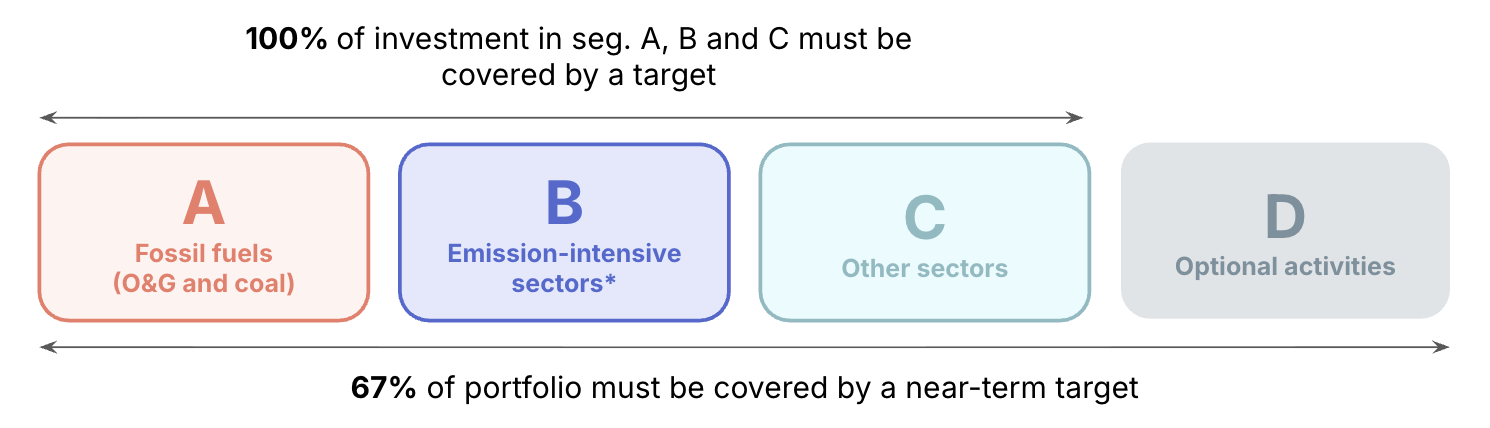

If you wish to take your NZ commitment to the next level, the Science Based Targets initiative (SBTi) provides the "stamp of approval." It is more prescriptive, requiring a straight-line decarbonization path, but offers a robust methodology and the highest level of market credibility. SBTi requires specific coverage thresholds (e.g., 67% of your portfolio must have targets) and mandates specific policies, such as phase-outs for fossil fuel financing. It is less about "how to do it" and more about "proving your targets are ambitious enough.”

SBTi near-term targets must cover 100% of segments A, B and C and at least 67% of the whole portfolio

Optional activities are defined based on the ownership level, investment mandate mode and are adapted to each financial activity.

Portfolio alignment involves financing climate solutions and ensuring that other assets have a credible Net-Zero trajectory

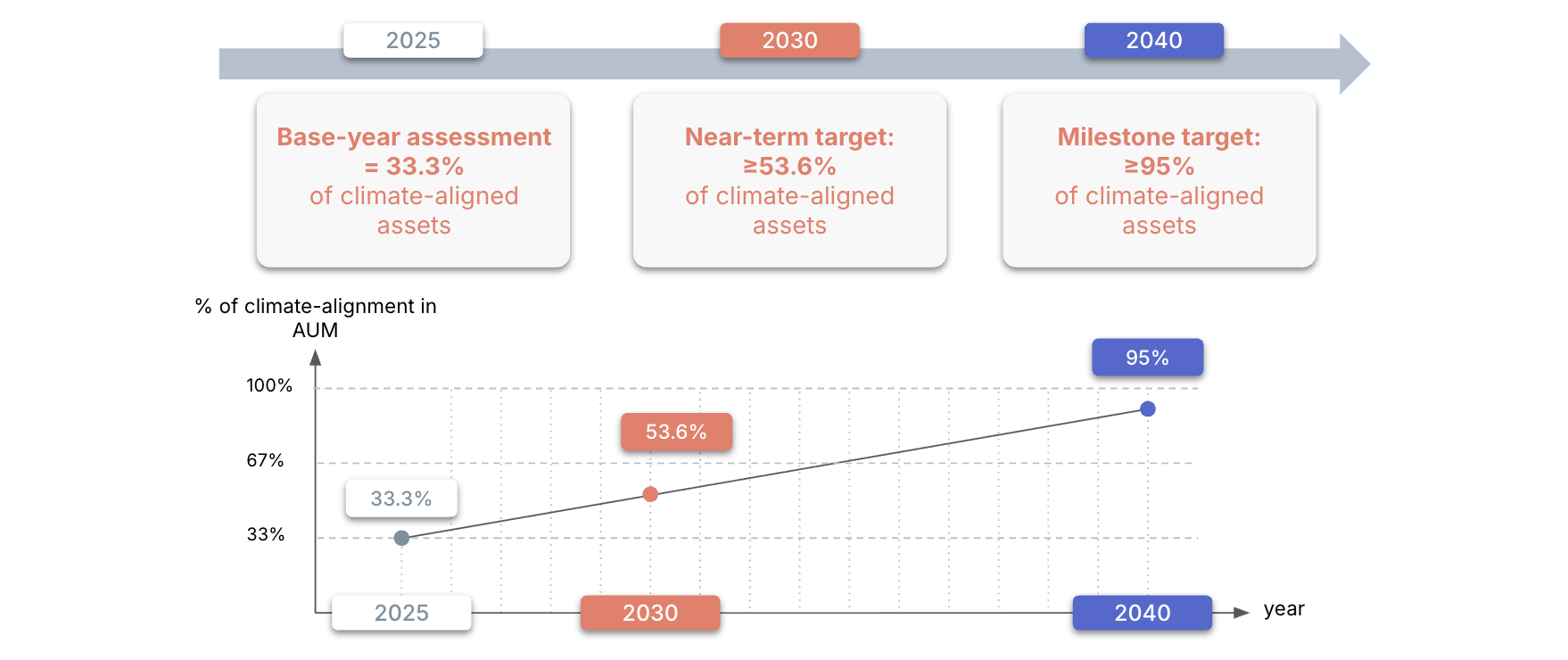

The share of climate-aligned AUM must increase linearly to reach ≥95% by 2040.

SBTi enforces a linear trajectory, ensuring that the right coverage level is reached by 2040

📖 If you want to know more, check out our webinar on SBTi Financial Institutions Net Zero Standard (FINZ).

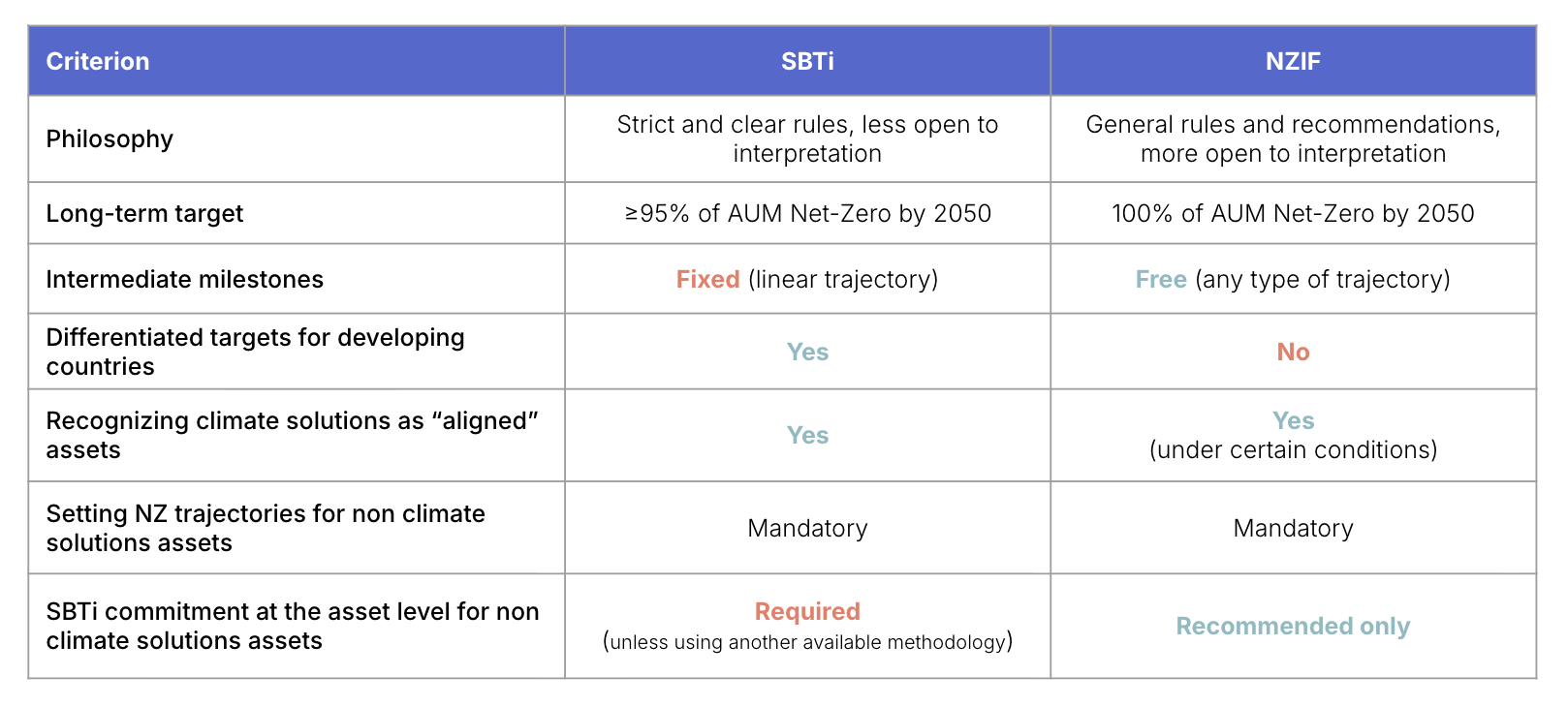

As a recap, here is a summary of all the main differences between NZIF and SBTi, the two target-setting tools.

Differences between NZIF and SBTi

Choosing and sequencing frameworks over time

As you can see, these frameworks also present a lot of synergies. The real power lies in using them in tandem to manage the maturity journey of your portfolio companies. Their different granularities in assessing maturity allow for an interesting interoperability: depending on your maturity, strategy or asset classes, you get get started with one, then move to another without having to start from scratch.

Interoperability: High-level compatibility of the frameworks together

The bottom line: start where you are

There is no "single best" framework. Financial institutions can for instance use PMDR to categorize their private market assets, NZIF to set targets on their whole portfolio, and SBTi to validate their headline commitments.

By choosing the right framework(s) for your climate strategy, you can make your ambition on climate is aligned with what science is asking, better manage risk and demonstrate real transition progress to your LPs and to the world.

📖 If you want to get into the specifics of the different frameworks, you’ll find the replay of our webinar here.